Utility Incentives

The state of Arizona is committed to a clean and sustainable future. PGT works closely with local utility companies to help homeowners go solar and save the most possible. APS and SPR are making it easier than ever to upgrade your home to be energy smart and save more with rebates. Check your local utility company to see the most current rebates and incentives.

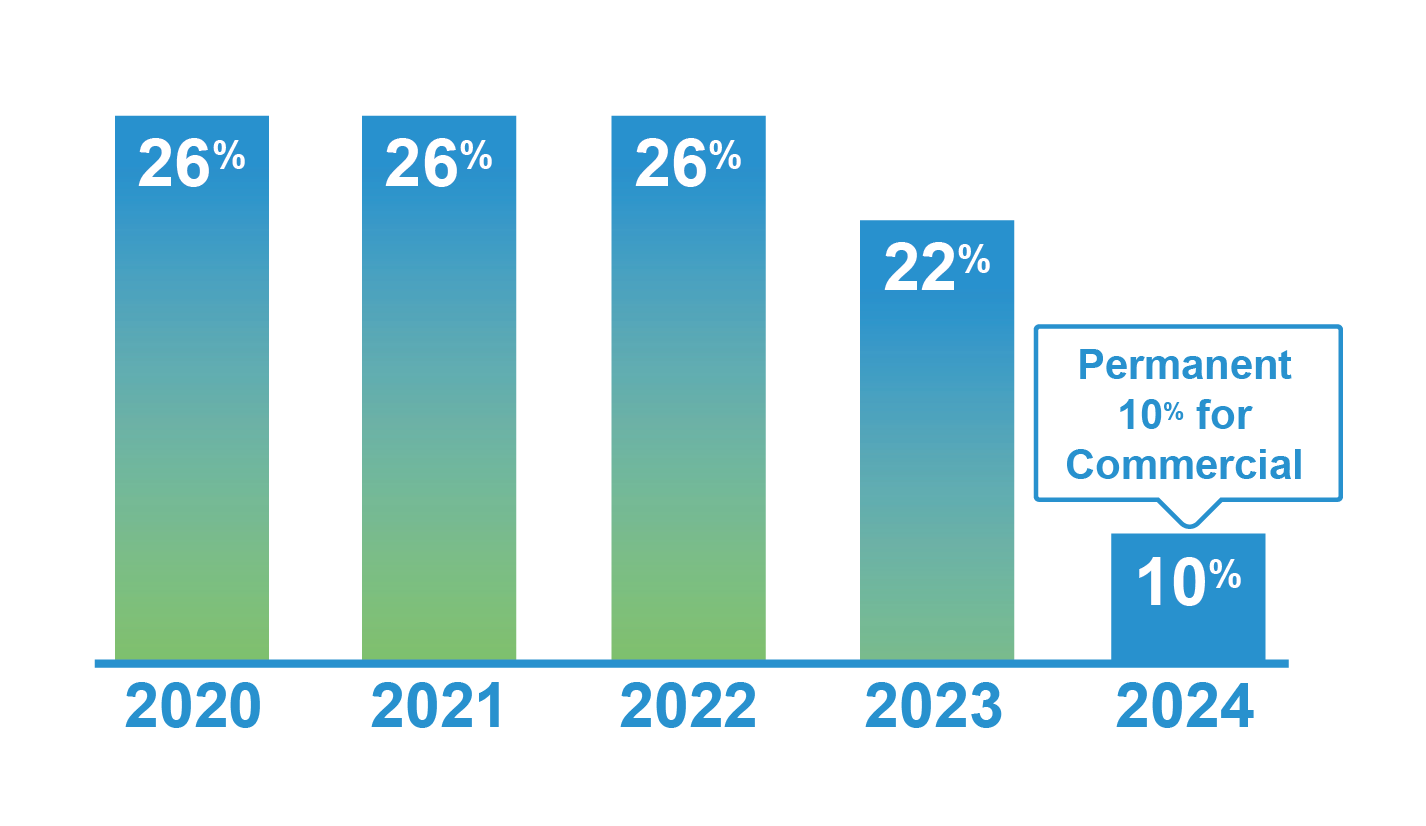

Federal Investment Tax Credit – 26%

The Solar Investment Tax Credit (ITC) is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The federal ITC is based on 26% of the homeowner’s cost to install solar. On leased systems, SunPower® collects this incentive and passes the savings on to the homeowner! Hurry and take advantage of this while it lasts, as this credit is scheduled to completely phase out by 2023.

Arizona Solar Tax Credit

The Residential Arizona Solar Tax Credit reimburses you 25% of the cost of your solar panels, up to $1,000, right off of your personal income tax in the year that you install the system. The credit is claimed in the year of installation. If the amount of the credit exceeds a taxpayer’s liability in a certain year, the unused portion of the credit may be carried forward for up to five years.

The Residential Arizona Solar Tax Credit reimburses you 25% of the cost of your solar panels, up to $1,000, right off of your personal income tax in the year that you install the system. The credit is claimed in the year of installation. If the amount of the credit exceeds a taxpayer’s liability in a certain year, the unused portion of the credit may be carried forward for up to five years.

Property Tax Exemption – 100% through 2024

Installing solar panels on your home increases its value up to 20 times your annual energy bill savings. We don’t think you should be penalized for your sustainable decision and many state legislators agree! Until the end of 2024, new solar installations will be subject to no additional property taxes based on their assessed value.

Installing solar panels on your home increases its value up to 20 times your annual energy bill savings. We don’t think you should be penalized for your sustainable decision and many state legislators agree! Until the end of 2024, new solar installations will be subject to no additional property taxes based on their assessed value.